995 Plan Coverage Amount - Anthony Martin is a nationally licensed insurance professional with over 10 years of experience and has personally served over 7000 clients with their life insurance needs. He regularly writes about business and life insurance for Forbes, Inc.com, Newsweek and Entreprenuer.com. Anthony has been interviewed as an expert life insurance resource for many top-rated websites, including Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance and more.

Jeff Root is a state licensed life insurance professional with 15 years of experience. He has personally assisted over 3000 clients with their life insurance needs. Jeff is an Amazon best-selling author and managing partner of a very successful insurance brokerage that holds over 2,500 licensed insurance agents in the USA. He has been a life insurance reporter for prominent websites such as Forbes, Bloomberg, MarketWatch, NerdWallet and many others.

995 Plan Coverage Amount

David Duford is a nationally licensed insurance professional with 10 years of experience. He has personally helped over 1500 customers purchase life insurance. David has been featured as an expert source for highly authoritative publications such as AM Best and Insurance Newsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents better serve their clients.

Sps: The Sylvia Protection System

This article has been carefully reviewed by the author and third-party life insurance experts to ensure it meets our quality standards for accurate and truthful advice.

To learn about Choice Mutual's commitment to transparency and integrity, read: Editorial Release, Fee Disclosure, and License Disclosure.

Our mission is to provide reliable content written by recognized experts and fact-checked to educate users like you. All content is regularly updated and reviewed to ensure the highest level of accuracy. We receive a commission from the sale of insurance products available on this website. Our reviews, comments, opinions and recommendations are not influenced by income. We always recommend to each customer what is best and what makes the most money.

As an independent insurance company, Choice Mutual receives a commission from our insurance partners every time we sell a policy. Without us, insurance companies would have no customers. Your policy won't cost you much because we help you and our advisory services cost you nothing. The actual amount we earn for each sale varies depending on the applicant's age, health and the product requested. We never recommend based on the products that pay us the most. We recommend products according to the needs and preferences of the applicant. It is also important to note that we pay our sales representatives on a salary rather than a commission-only basis. Choice Mutual does not make money by selling sales directories or data to third parties, referring users to other websites, displaying ads on our website, or otherwise.

A 'perfect Storm' Of Problems Plagues Florida's Home Insurance Market

Choice Mutual covers all 50 U.S. locations, including D.C. A licensed insurance agency is authorized to sell insurance in the states. You can view our license and permission procedures on our license page.

Martin, A. (2022, December 22). Colonial Penn Life Insurance Rate Charts by Age & Gender. . Retrieved January 22, 2023, from https:///colonial-penn-life-insurance-rate-chart/

Martin, Anthony. "Colonial Penn Life Insurance Rate Charts by Age & Gender" . Last updated on December 22, 2022. https:///colonial-penn-life-insurance-rate-chart/

Choice Mutual ratings are determined by our editorial team. The scoring formula takes into account user experience, financial strength and complaint data.

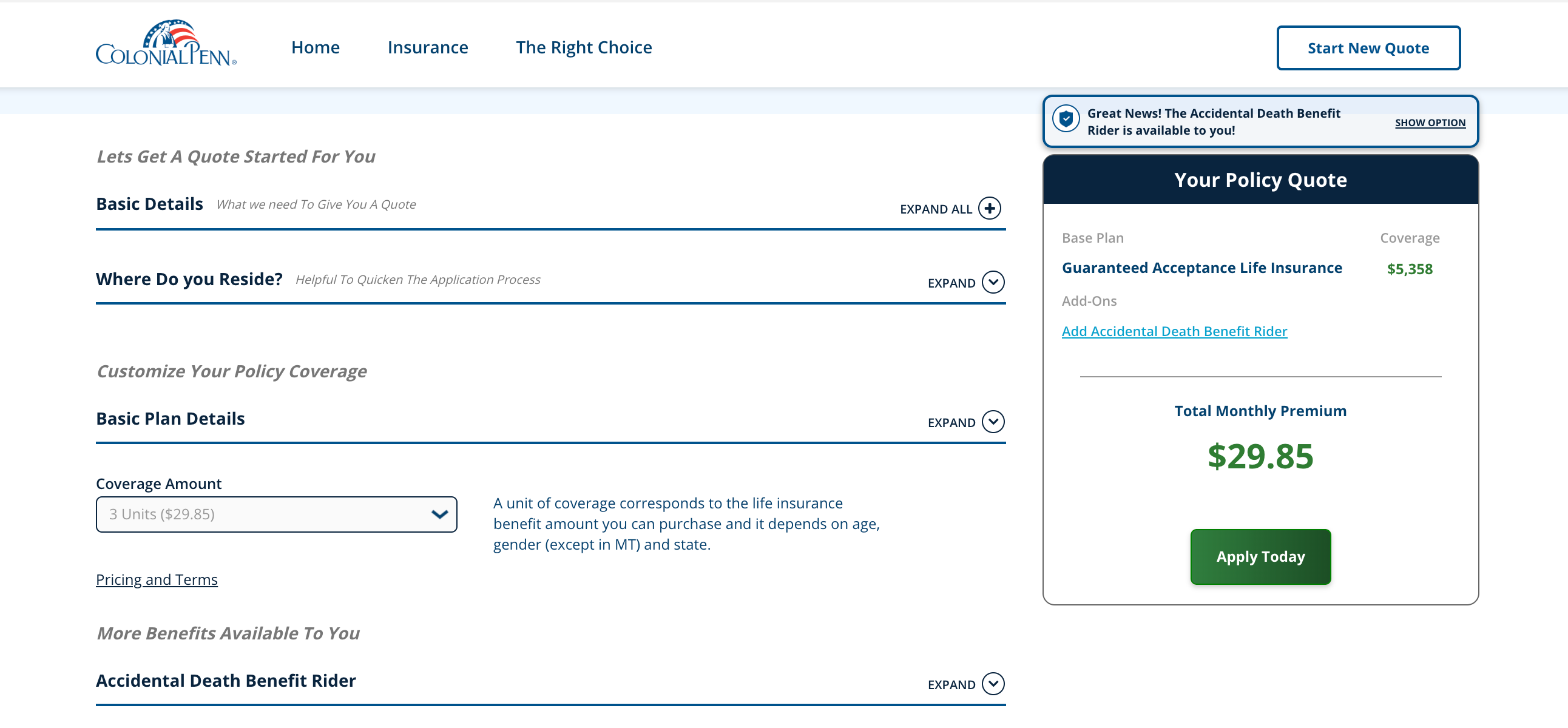

Colonial Penn Life Insurance Rate Chart (coverage Per $9.95)

It tells you exactly how much life insurance you'll get from one $9.95 unit based on your age and gender.

Below is a spreadsheet that shows the monthly cost you will pay based on the units you purchase.

Use the calculator below to find out how much time you will get per unit based on age and gender.

Please note that Colonial Pen's $9.95-unit plan is guaranteed approval, meaning it comes with a two-year waiting period. If you die during the waiting period, Colonial Pen will simply refund your premiums plus a small amount of interest.

Best Life Insurance For Seniors In 2023

The following Colonial Penn coverage chart shows how much life insurance you can get from a single coverage unit.

The Colonial Pen $9.95 program has a mandatory two-year waiting period. If you die within the first two years, Colonial Pen will refund your premiums plus a small amount of interest. This is an important factor to consider when weighing the pros and cons of colonial pen insurance.

Since it is a lifetime plan, the monthly rate does not increase and the coverage never decreases.

As shown in the table above, a 65-year-old woman would only get $1,258 in life insurance from one unit.

Castle Hills Annexation Information

Finally, you must have 50-85 subscriptions and 15 is the maximum number of units you can purchase.

After all, Jonathan Lawson (the actor in their ads) loudly and proudly announced that it only cost $9.95.

But if you look up the Colonial Penn life insurance rate chart, you'll quickly see how expensive it really is.

Many other funeral insurance companies offer inexpensive coverage and usually no waiting period.

Great Western Insurance Company Review

Their funeral insurance for seniors accepts applicants with diabetes, chronic heart disease or stroke, and many other conditions that are common among seniors.

Where to Apply: Agencies licensed to sell Mutual of Omaha products (you cannot purchase this plan directly from them)

Aetna Senior Products offers a final price policy with no waiting period, cheaper than Colonial Pen and accepts applicants over the age of 85.

Transamerica does not offer funeral insurance waiting periods for applicants with high-risk medical conditions such as COPD, kidney disease and lupus.

What Happens When Your Term Life Insurance Expires? (2023)

The Colonial Pen gets 1 out of 5 stars for overall performance. Choice Mutual ratings are determined by our editorial team. The allocation formula takes into account consumer information, complaint data from the National Association of Insurance Commissioners and a measure of financial strength.

If you pass the health questions, $50,000 in whole life insurance is the most coverage Colonial Penn offers. If you choose the $9.95 guaranteed receipt policy, you can purchase up to 15 units.

The coverage area from Colonial Pen varies depending on your age and gender. A 65-year-old man earns about $896 from a single share. A 65-year-old woman gets $1,258 in coverage from one unit.

Colonial Penn Life Insurance is a guaranteed whole life policy for $9.95 a month. Colonial Pen sells their coverage by the unit. How much coverage you get from each $9.95 unit depends on your gender and age.

Colonial Penn Life Insurance Review 2023

A portion of the cover with a colonial pen costs only $9.95. This applies to all ages and genders. The amount of coverage you get from each unit varies. For example, a 70-year-old woman earns $1,000 in one share and a 70-year-old man earns only $689 in one share.

By clicking "See Quotes Now" you agree to our Privacy Policy and consent to a Select Mutual representative contacting you by email, phone, text/SMS message on the phone and email you provide. Consent is not a condition of purchasing our products.

A list of the top insurance companies in the country and the leading insurance companies.

A full explanation of how much final insurance costs. Check out the complexity of the quotes for years 40-89 as well as tips for finding the best policy for the lowest rate.

News > About Us

Colonial Penn Life Insurance Policy Options, Customer Complaints, Prices, Main Features, Pros & Cons. A perfect summary of the pros and cons.

By clicking "Submit" you agree to our Privacy Policy and consent to a Select Mutual representative contacting you by email, phone, text/SMS message on the mobile phone and email you provide. Consent is not a condition of purchasing our products. You're flipping through the channels, trying to find something to watch, when an old familiar face comes on TV.

"I can, Alex," you tell the TV, turning up the volume and getting more focused.

What your friend won't tell you is in a good book. Colonial Penn offers life insurance that is sold in a way that most do not - on a per unit basis.

Top 10 Final Expense Life Insurance Companies In 2023

And while Colonial Pen would have you think it's a good deal, it's a lot farther from the truth than you might think.

You've lived long enough to feel real.

Find out why Colonial Penn Life Insurance $9.95 Unit policy for seniors is not your best choice and could be one of your worst choices to prepare for when the good Lord calls you home.

.png)

When you buy life insurance from a reputable life insurance company, you are buying a death benefit, not a life insurance policy. For example, let's say you need to pay for funeral expenses and final medical bills, so you need $25,000 in coverage.

How Do Deductibles Affect Car Insurance Premiums?

With a life insurance company, you can buy the full coverage. With Colonial Pen, you can buy only one unit.

Units are a bit weird because the number of deaths you get decreases as you get older, but the cost of the units stays the same.

Let's say you are a 68-year-old man living in Houston. You call Colonial Pen to get one

Renters insurance liability coverage amount, renters insurance coverage amount, coverage amount, personal property coverage amount, colonial penn 995 plan coverage amount, fdic coverage amount, colonial penn 995 plan coverage, colonial penn 995 coverage, colonial penn $9.95 plan coverage amount, life insurance coverage amount, home insurance dwelling coverage amount, health insurance coverage amount

0 Comments